This event starts in...

Don’t Make These 2 BIG Mistakes When Going “Big Game Hunting”

By Ian King

One of the biggest mistakes you can make when investing for BIG gains is to think a small-cap stock has to trade for less than $10.

While many do … that’s not always the case.

When I go big game hunting, I don’t care about a stock’s share price.

Primarily what I’m looking at is its market cap … the stock’s price is irrelevant.

There are $20, $40, even $70 stocks that qualify as small-caps and have the potential to 10X your investment inside of a decade.

Look at Wix.com, the popular website software company…

Its shares were trading for $28 in 2016.

So, to 10X, the share price would have to go up to $280 dollars.

A lot of people who simply looked at its stock price might have thought that is was an unlikely target.

But, again, it’s a big mistake to get stuck on price…

Because Wix.com’s market cap was a mere $1.2 billion.

Combined with several other factors that we’ll get to in a moment, this stock had plenty of room to run.

Over the next four years, it went on a tear … gaining 1,012%.

And today it trades for over $280.

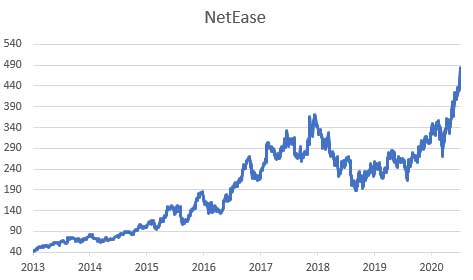

Another example is NetEase, a gaming software company.

Its shares were trading for $42 in 2013.

That means to 10X it would have to go up to $420 a share.

Price watchers might see that as even more unlikely to happen.

But price is irrelevant.

NetEase’s market cap was still in the small-cap range at $5.5 billion.

And the stock still had a lot of room to run.

Over the next eight years, it shot up 1,094%.

Today, NetEase trades for well over $420. (Numbers before recent 5 to 1 split.)

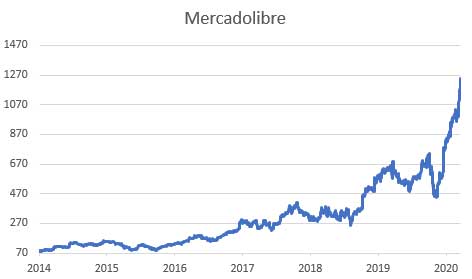

And look at MercadoLibre, a company many people call the “Amazon of Latin America.”

It was trading for $79 back in 2013.

If you focus on price, that means to 10X this stock would have to go up to $790 a share.

But the market cap was just $3.2 billion.

And over the next seven years the stock gained 1,470%.

Today MercadoLibre trades for over $790 per share.

The fact is, stocks over $10 can also go up 1,000% or more.

The key is to find a company with a small market cap and a disruptive new technology … and that’s where the massive profits can be found.

That’s why my strategy for targeting 10X stocks focuses on market cap … not price.

The second big mistake many people make when targeting fast-moving stocks is timing when to get into the stock.

This is one of the critical skills I’ve honed over my two decades as a professional investor.

Get the timing wrong and it could mean missing out on tens of thousands, or even hundreds of thousands of dollars depending on your investment.

For example, from March 2020 to August 2020, ACM Research rewarded investors with 399% gains.

However, if you had waited two months to invest you would’ve only seen a 78% return.

That’s the difference between turning every $10,000 invested into a profit of $39,900…

Versus just $7,800.

Waiting on the sidelines just two months would have cost you more than $32,000!

Livongo Health is another example where time equals money in the bank.

From March 2020 to August 2020, Livongo Health went on a 495% run.

Every $10,000 invested would have made you a profit of $49,500.

Getting in just two months later would’ve meant a 102% return.

Still good … but your $10,000 invested would have given you a much lower profit of $10,200.

By waiting just two months, you’d have missed out on nearly $40,000 in profits.

So while many people choose to get in when they see a news story about the stock…

Fair warning, that’s often too late.

Once the media has caught wind of a great opportunity, chances are everyone knows about it and the big money has already been made.

My New Era Fortunes strategy looks for stocks that aren’t on the front page yet.

And on Thursday, I’ll go into great detail to show you how it works … so you can learn how to invest before the herd.

Like I said, timing is something I’ve spent years analyzing and trying to perfect. If you are looking to dramatically increase your wealth, it helps to be able to target the optimal time to buy a stock.

Again, stay tuned to this page.

In my next blog post, I’ll show you exactly how timing has helped my Automatic Fortunes subscribers get into even large-cap stocks and see gains up to 919% in 13 months.

And, of course, I’ll get more in-depth on these skills for finding potential 10X winners in the New Era Fortunes Summit at 1 p.m. EDT on Thursday.

—Ian King